LogistiCare Mileage Reimbursement Trip Log and free printable template

Show details

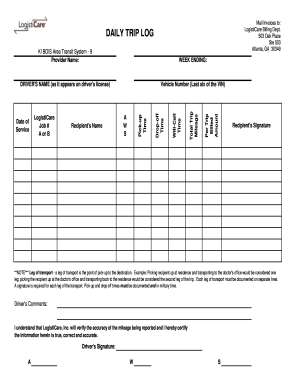

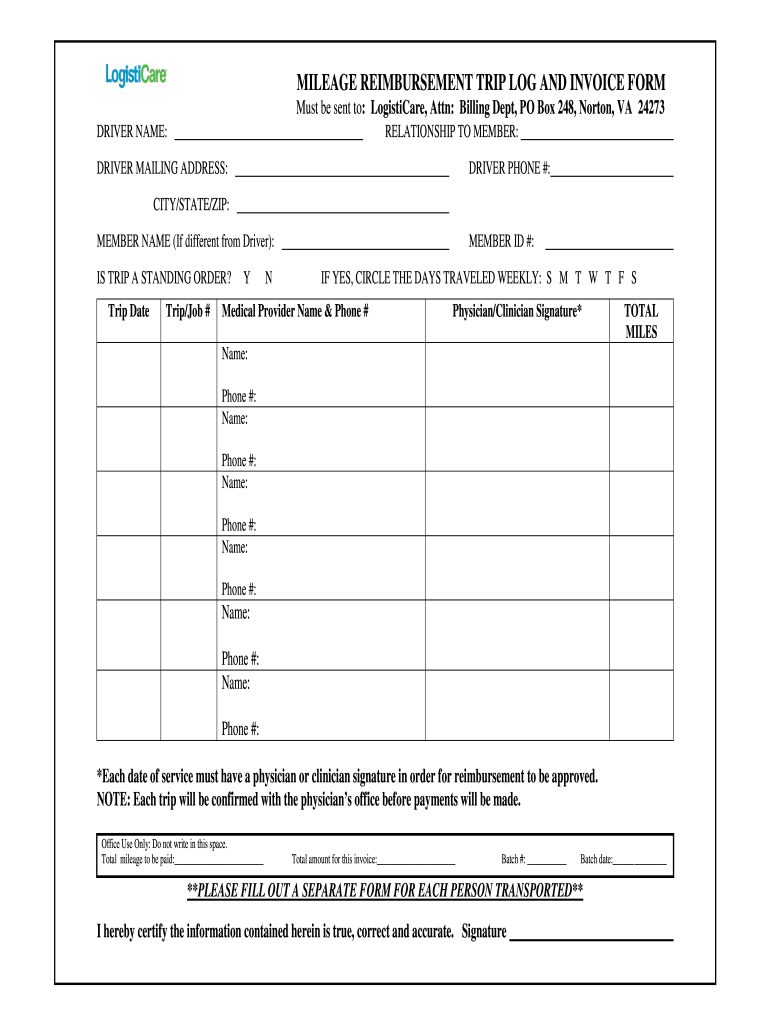

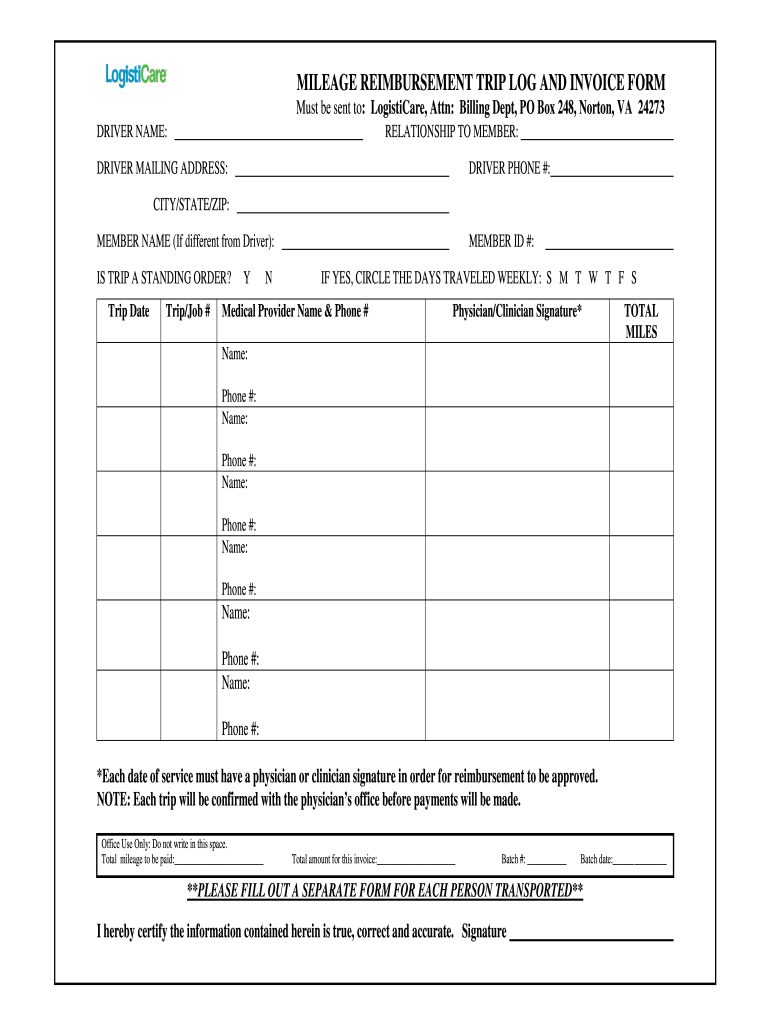

MILEAGE REIMBURSEMENT TRIP LOG AND INVOICE FORM Must be sent to LogistiCare Attn Billing Dept PO Box 248 Norton VA 24273 DRIVER NAME RELATIONSHIP TO MEMBER DRIVER MAILING ADDRESS DRIVER PHONE CITY/STATE/ZIP MEMBER NAME If different from Driver IS TRIP A STANDING ORDER Trip Date Trip/Job Y N MEMBER ID IF YES CIRCLE THE DAYS TRAVELED WEEKLY S M T W T F S Medical Provider Name Phone Physician/Clinician Signature TOTAL MILES Name Phone Each date of service must have a physician or clinician...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign modivcare mileage reimbursement form

Edit your modivcare mileage reimbursement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your logisticare mileage reimbursement form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing modivcare mileage reimbursement form pdf online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit mileage reimbursement trip form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out modivcare gas reimbursement form

How to fill out LogistiCare Mileage Reimbursement Trip Log and Invoice

01

Obtain the LogistiCare Mileage Reimbursement Trip Log and Invoice form from the LogistiCare website or your local office.

02

Fill in your personal information, including your name, address, and phone number.

03

Enter the date of the trip in the designated section.

04

Indicate the starting and ending addresses for each trip.

05

Record the total miles traveled for each trip in the designated column.

06

Sign and date the form to verify that the information provided is accurate.

07

Attach any necessary supporting documents, such as receipts or appointment confirmations.

08

Submit the completed form according to the instructions provided, either online or via mail.

Who needs LogistiCare Mileage Reimbursement Trip Log and Invoice?

01

Individuals who use LogistiCare services for medical transportation and wish to claim reimbursement for mileage expenses.

Fill

modivcare gas mileage reimbursement form

: Try Risk Free

People Also Ask about modivcare mileage reimbursement trip log

Does mileage reimbursement count as income 1099?

Generally, mileage reimbursement is not taxed as income.

Is mileage reimbursement taxable 1099?

You may be wondering if that reimbursement is taxed or if all of it goes back into your pocket. Generally, mileage reimbursement is not taxed as income.

Do I need to report mileage reimbursement on my taxes?

Typically, the reimbursement stays non-taxable as long as the mileage rate used for reimbursement does not exceed the IRS standard business rate ($0.655/mile for 2023).

How many miles can you claim on a 1099?

There's no upper limit to how many miles you can claim a deduction for as long as you drive them for business. There are a few more things to consider though, and we've compiled a brief list. Types of transportation that are considered business: Driving between two different places of work.

What form do I fill out for mileage reimbursement?

You can fill out Schedule C in paper form or online by using an IRS e-file or a professional tax service. If you are deducting mileage for medical purposes, the mileage deduction will be deducted as part of your total unreimbursed medical expenses on Schedule A, line 1.

What is a mileage expense form?

A mileage reimbursement form is primarily used by employees seeking to be paid back for using their personal vehicles for business use. Seeing as there is no way to properly calculate the true cost of performing the trip by the employee, the IRS announces these rates on an annual basis for employers and businesses.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete modivcare wv mileage reimbursement form online?

Easy online modivcare gas reimbursement form log completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

Can I create an electronic signature for signing my modivcare wv mileage reimbursement in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your logisticare mileage reimbursement right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How can I edit modivcare mileage reimbursement form wv on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing modivcare formerly logisticare forms right away.

What is LogistiCare Mileage Reimbursement Trip Log and Invoice?

The LogistiCare Mileage Reimbursement Trip Log and Invoice is a document used to track and request reimbursement for mileage incurred while providing transportation services for eligible individuals.

Who is required to file LogistiCare Mileage Reimbursement Trip Log and Invoice?

Individuals or organizations providing transportation services to eligible individuals under the LogistiCare program are required to file the Mileage Reimbursement Trip Log and Invoice.

How to fill out LogistiCare Mileage Reimbursement Trip Log and Invoice?

To fill out the LogistiCare Mileage Reimbursement Trip Log and Invoice, you need to provide details such as the date of travel, origin and destination addresses, total mileage driven, purpose of the trip, and any associated costs.

What is the purpose of LogistiCare Mileage Reimbursement Trip Log and Invoice?

The purpose of the LogistiCare Mileage Reimbursement Trip Log and Invoice is to ensure that individuals and organizations can accurately track their transportation expenses and receive appropriate reimbursement for mileage incurred while assisting eligible clients.

What information must be reported on LogistiCare Mileage Reimbursement Trip Log and Invoice?

The information that must be reported on the LogistiCare Mileage Reimbursement Trip Log and Invoice includes the date of the trip, starting and ending locations, total mileage, purpose of the trip, and related expenses.

Fill out your LogistiCare Mileage Reimbursement Trip Log and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Logisticare Reimbursement Form is not the form you're looking for?Search for another form here.

Keywords relevant to mileage reimbursement modivcare

Related to modivcare trip log

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.